Feeling overwhelmed by the maze of Medicare options and enrollment deadlines? You are not alone. Working with a dedicated Medicare Agent is the clearest path to navigating this complex system with confidence. The team at Health Plan Experts is here to provide personalized, no-cost guidance, helping you find a plan that truly fits your life and your needs.

The Personal Touch of a Medicare Agent

In an age of automated phone systems and confusing websites, the value of a human connection cannot be overstated. A local Medicare Agent offers something that online portals cannot: personalized advice tailored to your unique situation. They take the time to understand the full picture of your health and lifestyle.

This includes your specific prescriptions, your preferred doctors and hospitals, and your budget. This deep understanding is crucial for finding the right fit among a sea of options. An agent acts as your translator and advocate. They decipher the jargon of deductibles, copayments, and networks, presenting your options in plain, simple language.

Instead of you spending hours researching dozens of plans, they do the heavy lifting. Independent agents are not tied to a single insurance company. This means the professionals at Health Plan Experts can compare plans from various carriers, giving you an unbiased look at what is available. Their objective is not to push one specific plan but to find the one that offers you the best coverage and value. They help you weigh the pros and cons of each option, empowering you to make a well-informed decision that you can feel good about for the year to come.

Navigating Enrollment and Beyond with a Medicare Agent

What are the benefits of a Medicare Agent?

Choosing a plan is just the first step. A great Medicare Agent provides support long after you enroll, especially since your healthcare needs can change over time. They help you understand the different enrollment periods, such as the Initial Enrollment Period when you first become eligible and the Annual Enrollment Period when you can make changes. Missing these windows can lead to lifelong penalties, a costly mistake an agent helps you avoid. Their guidance is a year-round resource, not a one-time transaction. They become your go-to person for any questions or issues that may arise with your coverage.

Here are some of the key ways an agent can assist you:

- Comparing Drug Plans: They analyze your medication list against different Part D plan formulas. They check for coverage tiers and help you understand potential costs, including the dreaded “donut hole” or coverage gap, to find a plan that covers your prescriptions at the lowest out-of-pocket cost.

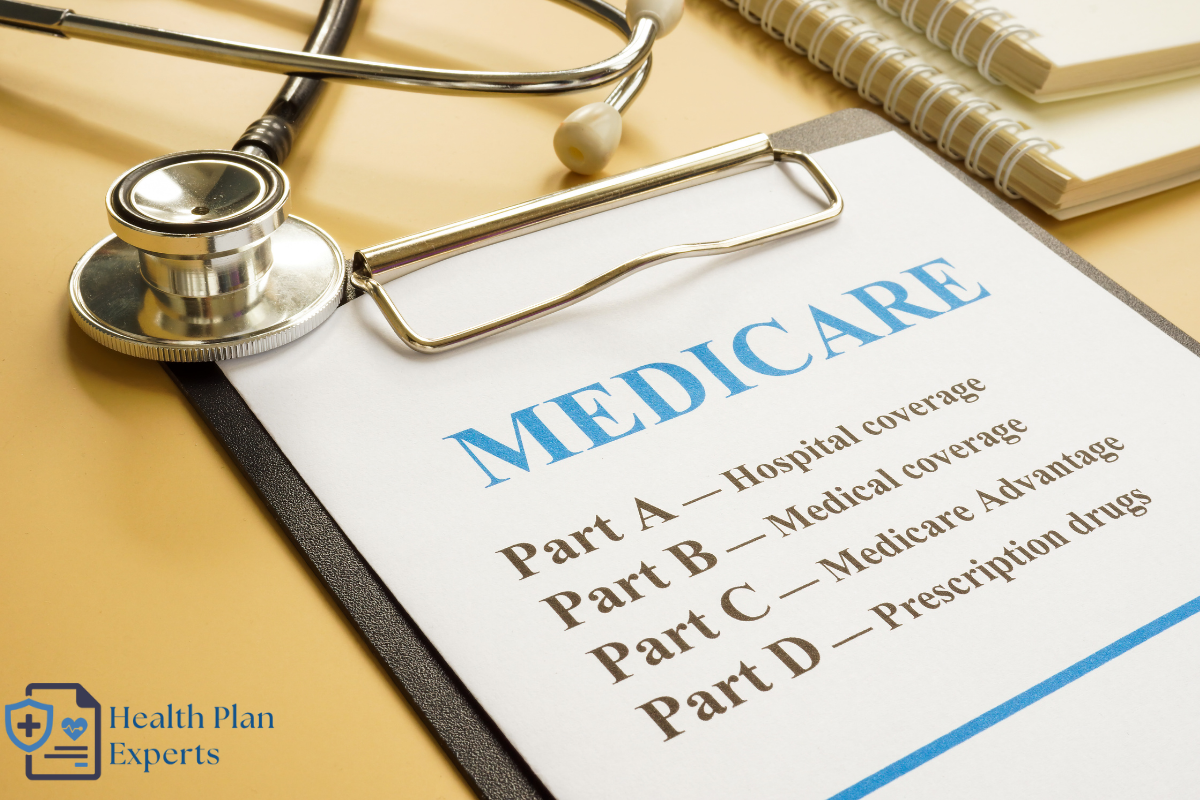

- Explaining Your Core Choices: They clarify the fundamental differences between Original Medicare with a Medigap supplement plan and a comprehensive Medicare Advantage (Part C) plan. They’ll discuss network flexibility, out-of-pocket maximums, and extra benefits like dental or vision to help you choose the right path.

- Checking Networks: Before you sign up, they verify that your trusted primary care physician, specialists, and preferred hospitals are included in a plan’s network. This prevents the unwelcome surprise of finding out your doctor is out-of-network when you need care.

- Providing Annual Reviews: Insurance companies can change their benefits, formularies, and costs every year. An agent provides an annual review to see if your current plan is still the best option or if a different one would better suit your evolving health and financial needs.

This ongoing support provides immense peace of mind, knowing you have an expert in your corner.

Partner with an Expert Today

Working with an independent Medicare agent costs you nothing but can save you from making costly mistakes. They are your dedicated partner in navigating your healthcare journey. The team at Health Plan Experts is ready to answer your questions and simplify the process. Contact us today for a no-cost consultation.